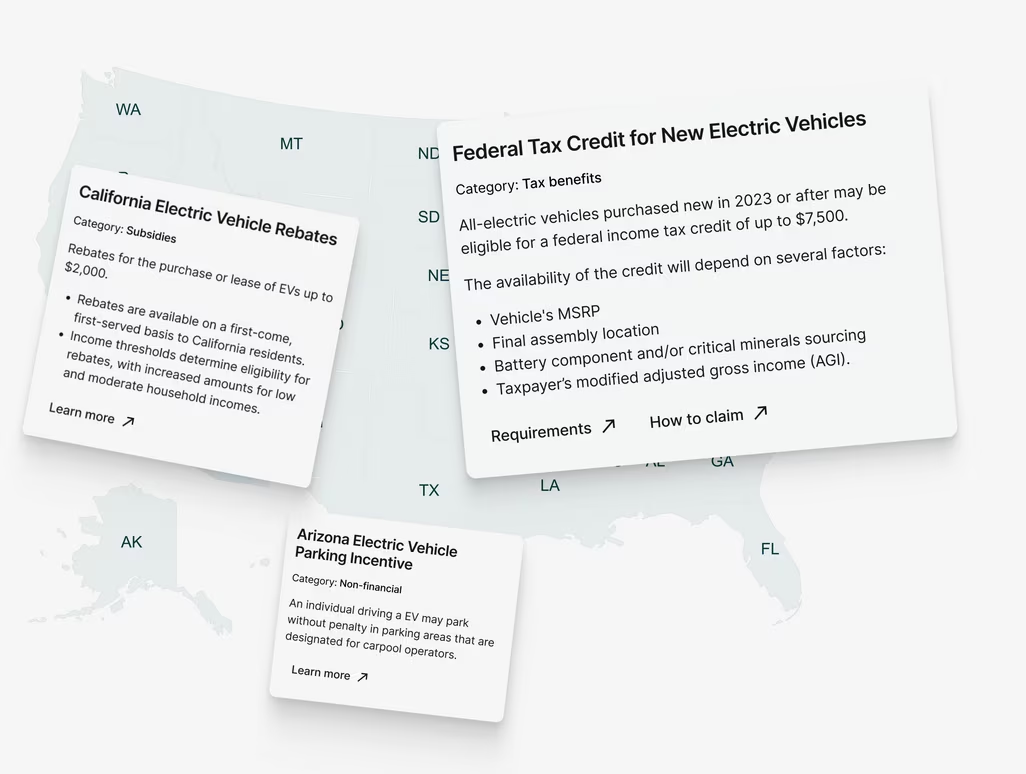

Explore Your State Incentives

Discover what incentives you can access in your state with our interactive EV incentives map.

Explore EV Incentives

| Year | EV | ICE | EV ROI |

|---|---|---|---|

| 0 | |||

| 1 | |||

| 2 | |||

| 3 | |||

| 4 | |||

| 5 |

The electric vehicle will pay for itself right away. will pay for itself in years. won’t pay for itself in 5 years. It costs less more upfront (after accounting for in EV incentives), and saves about in fuel each year. Monthly lease payments are lower higher for the EV compared to the ICE car. Your net cost savings in five years will reach approximately . remain negative.

These estimates are based on current conditions and don't include things like gas and electricity prices changing, or car maintenance and insurance costs.

Discussion