All You Need to Know About EV Insurance

So, you’ve made the switch to an electric vehicle — congratulations! Whether you’re cruising in a sleek Tesla, a practical Kia EV9, or a cutting-edge Lucid Air, there’s one thing you can’t overlook: insurance.

You might be wondering, “Is insuring an EV different fr om a gas car? Will it cost more? Do I need special coverage?” The short answer? Yes and no.

While electric cars share many insurance basics with traditional vehicles, they also come with unique factors — like expensive battery replacements, specialized repairs, and even coverage for charging equipment.

Before you hit the road, it’s crucial to understand what makes EV insurance different, what affects your premiums, and how to find the best policy without overpaying. In this guide, we’ll break it all down in simple terms — no confusing jargon, just everything you need to know to insure your EV smartly and affordably. Let’s get started!

Table of Contents

Key Factors That Affect EV Insurance Costs

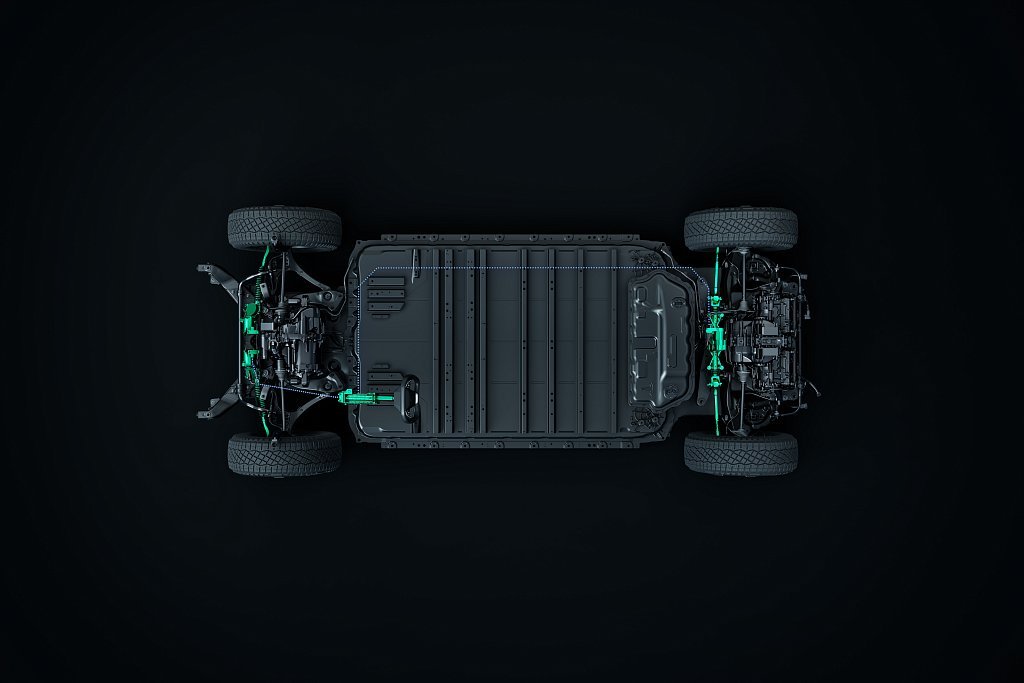

At first glance, insuring an electric vehicle (EV) might seem just like insuring any other car. You still need liability coverage, collision protection, and all the usual add-ons. But when you take a closer look, EV insurance has some key differences — mainly due to the technology under the hood (or rather, under the floor).

Vehicle Value & Repair Costs

One of the biggest factors affecting insurance costs is the price of the car itself. Since many EVs have higher upfront costs than gas-powered cars, insurers factor that into their pricing.

- Battery Replacement – The battery pack is the most expensive part of an EV, sometimes costing $10,000 or more to replace. Even minor damage can require costly fixes.

- Advanced Technology – EVs come packed with high-tech features like driver assistance systems, cameras, and sensors. While these improve safety, they also raise repair costs after an accident.

- Specialized Repair Shops – Not every mechanic can handle high-voltage EV components. Repairs often require trained specialists, which means higher labor costs.

Safety Features & Crash Ratings

EVs are generally safer than gas cars, thanks to low centers of gravity (reducing rollover risks) and advanced driver-assistance systems. Insurers reward vehicles with high safety ratings by offering lower premiums.

- Due to the unique construction of EVs, including the placement of the heavy battery under the floor and special protection zones at the front, electric vehicles are often considered safer than traditional cars.

- Automatic emergency braking, lane assist, and collision warning reduce accidents and claims.

- Modern EVs now typically include artificial sounds to alert pedestrians, addressing a safety concern from earlier models that lacked such external noise.

Charging & Fire Risks

EV battery fires are rare but can be harder to extinguish than gasoline fires. Insurers may factor in:

- Battery Safety Ratings – Some EVs (like Tesla and Hyundai) use better thermal management systems to prevent overheating.

- Charging Incidents – While home charging is generally safe, surges, charger malfunctions, or faulty wiring could lead to property damage claims.

Tip: If you’re installing a home charger, tell your insurer. Some offer discounts for certified charger installations that reduce fire risks.

Theft Rates

Good news! EVs are stolen less often than gas cars. Why?

- Many require a key fob or smartphone app to start.

- They often have GPS tracking, making them easier to recover.

- EV charging stations lim it getaway options — thieves can’t just refill at any gas pump.

Tip: What if your charging cable gets stolen or damaged? Some insurance policies even offer charging equipment coverage.

Location & Usage

Your zip code plays a big role in your EV insurance rate. Insurers look at:

- Urban vs. Rural Areas – Cities have higher accident and theft rates, increasing costs.

- Annual Mileage – Lower mileage EV drivers often get discounts since they’re on the road less.

- Climate Conditions – Extreme heat or cold can affect battery longevity, but insurers rarely adjust rates for this.

Tip: If you drive fewer than 7,500 miles per year, ask about low-mileage discounts — EV drivers often qualify!

Bottom Line

While EVs tend to have higher repair costs, their strong safety features and lower theft rates help offset insurance premiums. Understanding these key factors can help you choose a cost-effective policy and even lower your rates.

Next up: What types of coverage should you consider for your EV?

Types of EV Insurance Coverage

Not all car insurance policies are created equal — especially when it comes to electric vehicles. While the basics like liability, collision, and comprehensive coverage still apply, EV owners should consider additional protections that cover the unique aspects of their cars, like battery damage, charging equipment, and roadside assistance.

Let’s break down the coverage types for EVs.

Liability Insurance

Just like gas cars, liability insurance is mandatory in most states. It covers:

- Bodily Injury Liability – Pays for medical expenses if you injure someone in an accident.

- Property Damage Liability – Covers damage to other vehicles, buildings, or public property.

Tip: EVs often have strong acceleration and quick torque, which can lead to rear-end collisions if drivers aren’t careful. Consider higher liability limits for extra protection.

Collision & Comprehensive Coverage

While liability insurance covers other people’s damages, collision and comprehensive insurance protect your own car.

- Collision Coverage – Pays for repairs if your EV is damaged in an accident, regardless of fault.

- Comprehensive Coverage – Covers damage from theft, vandalism, floods, fires, fallen trees, and even animal collisions.

Tip: If you have a leased or financed EV, collision and comprehensive coverage may be required by your lender.

Battery & Powertrain Coverage

The battery is the heart of your EV — and also its most expensive component. Most manufacturer warranties cover battery defects for 8 years or 100,000+ miles, but damage from accidents may not be covered.

Some insurers offer optional battery coverage, which can protect against:

- Battery damage in a crash (even minor impacts can lead to costly replacements).

- Overcharging, electrical surges, or charging station malfunctions.

Tip: Check if your EV’s manufacturer warranty already covers battery replacement before adding extra coverage.

Charging Equipment Coverage

Charging at home? You’ll want charging equipment coverage to protect against:

- Damage to your home charger from power surges, vandalism, or accidents.

- Theft of your charging cable (yes, it happens!).

- Liability if someone gets injured using your home charger.

Tip: Check whether your home insurance already covers your wall charger before adding extra protection to your car policy.

Roadside Assistance

Traditional roadside assistance doesn’t always meet the needs of EV drivers. Many insurers now offer EV-friendly roadside assistance, which includes:

- Flatbed Towing – EVs should not be towed with traditional tow trucks to avoid motor damage.

- Mobile Charging Services – Some providers will bring a portable charger to get you back on the road.

- Tire and Key Assistance – Just like gas cars, flats and lockouts can happen!

Tip: Some automakers (like Tesla, Rivian, and Hyundai) offer free roadside assistance for new EV owners — check before buying additional coverage.

Bottom Line

EV insurance isn’t just about standard auto coverage — you need to consider battery protection, charging equipment, and EV-specific roadside assistance. Taking the time to tailor your policy can save you thousands in unexpected costs.

Next up: How can you lower your EV insurance premiums?

How to Lower Your EV Insurance Premiums

While EV insurance can be slightly more expensive than traditional car insurance, there are plenty of ways to cut costs without sacrificing coverage. Here are some of the best strategies to lower your premiums and keep more money in your pocket.

1. Shop Around & Compare Quotes

Insurance rates vary significantly between providers. Some insurers specialize in EV-friendly policies and offer discounts for electric cars. Instead of settling for the first quote you get, try:

- Comparing Multiple Providers – Use online comparison tools or consult an independent agent.

- Looking for EV-Friendly Insurers – Some companies offer special rates for electric cars.

- Checking for Bundling Options – Combining auto + home insurance can lead to discounts.

Tip: Looking for an easy way to compare insurance options? Our partner TrySmartly simplifies the process by connecting you with top-rated providers, helping you save time and money.

2. Take Advantage of EV-Specific Discounts

Many insurance companies reward EV drivers with discounts, including:

- Eco-Friendly Vehicle Discounts – Some insurers offer 5–10% off just for driving an electric car.

- Low Mileage Discounts – If you drive under 7,500 miles per year, you could save big.

- Safe Driving Programs – Telematics programs (like GEICO’s DriveEasy or Progressive’s Snapshot) can reduce your rate if you drive cautiously.

- Advanced Safety Features Discounts – Many EVs come with ADAS (Advanced Driver Assistance Systems), which can qualify for lower premiums.

3. Increase Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Raising your deductible from $500 to $1,000+ can lower your monthly premium, sometimes by 15% or more.

Tip: Only increase your deductible if you have enough savings to cover it in case of an accident.

4. Choose an EV with Lower Repair Costs

Some EVs are cheaper to insure than others. Factors that affect insurance costs include:

- Battery Replacement Costs – Some brands (like Hyundai and Kia) have cheaper battery repairs.

- Availability of Parts – Popular models (like the Tesla Model 3) have widely available parts, reducing repair costs.

Tip: Before buying an EV, get an insurance quote first to see how much it’ll cost to insure.

5. Maintain a Clean Driving Record

The simplest way to keep your insurance costs low? Drive safely! Avoiding accidents, speeding tickets, and claims can help you qualify for the lowest possible rates.

Tip: Many insurers offer a “good driver” discount of up to 25% if you stay claim-free for 3+ years.

Bottom Line

While EV insurance can be slightly pricier, there are plenty of ways to save. By shopping around, taking advantage of EV discounts, and making smart coverage choices, you can reduce your premium and still get top-notch protection.

Final Thoughts

Electric vehicles are revolutionizing the way we drive, and insuring them requires a fresh approach. While EV insurance may have some differences from traditional car coverage, understanding what impacts costs, the types of coverage available, and how to save on premiums can help you make an informed decision.

By choosing an EV-friendly insurer, taking advantage of available discounts, and comparing quotes from multiple providers, you can ensure that you get the best coverage at the right price.

Discussion